Stocks are an important part of any portfolio because of their potential for growth and higher returns versus other investment products. To determine how much you should allocate to stocks, you should first develop a comprehensive financial plan that reflects your investment horizon and the level of risk you're willing to accept in exchange for the potential upside stocks can offer.

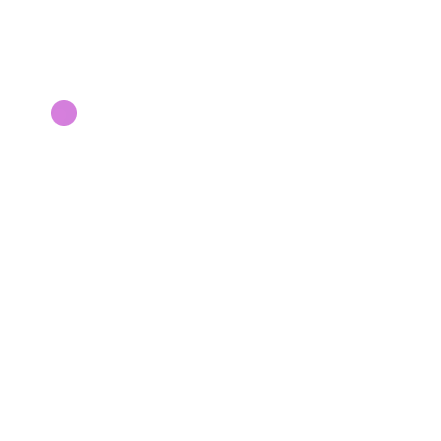

Asset classes perform differently, and it's nearly impossible to predict which asset class will perform best in a given year. If you had invested $100,000 in just U.S. Stocks in 1997, it would have almost quadrupled to $400,000 by 2017, but there would have been many ups and downs due to volatility. A more diversified investment portfolio would have had a lower return, but reduced volatility.